60 Decibels Microfinance Index is an annual initiative to gather impact outcomes data directly from microfinance clients so financial services providers and their funders can compare social performance.

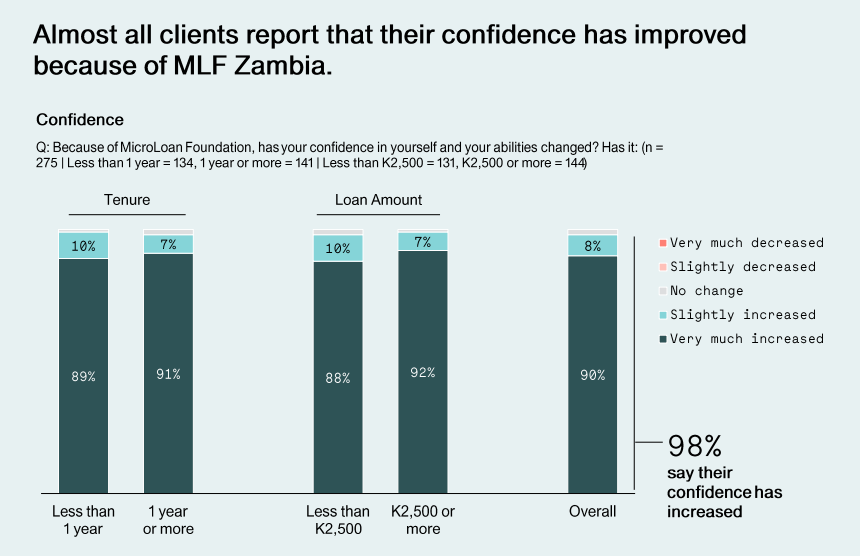

Compared to a benchmark of 118 Microfinance organisations, we are proud to say that we scored in the top 20% in all categories, including Client Profile & Access, Business Impact, Household Impact, Client Protection, Resilience, and Agency. These results showcase the incredible impact that our work is having on the lives of our clients.

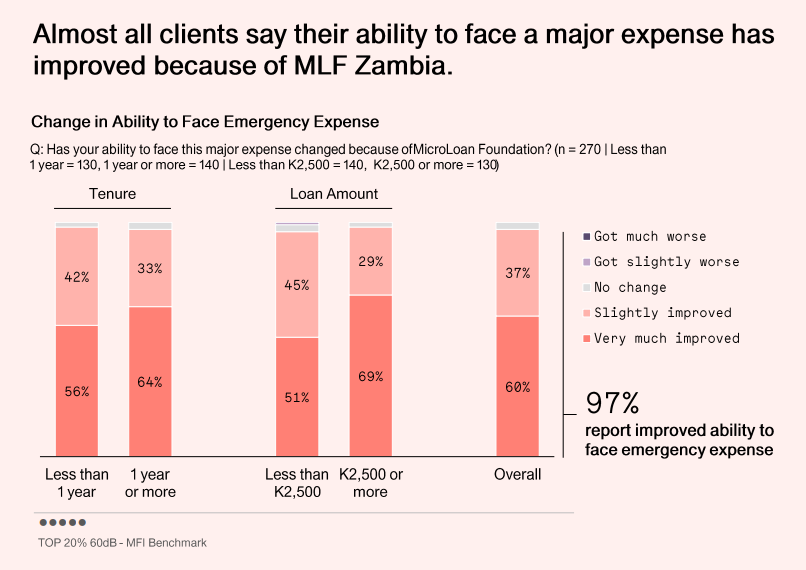

Ensuring our clients are equipped with the necessary tools to rebuild after emergencies is crucial in fulfilling our mission. In the face of numerous challenges, such as the global pandemic and natural disasters, poor communities often struggle to cope. That’s why we take great pride in knowing that 97% of our clients have reported an improved ability to face emergency expenses. We believe that supporting our clients to overcome adversity is a fundamental aspect of our work, and we remain committed to supporting them every step of the way.

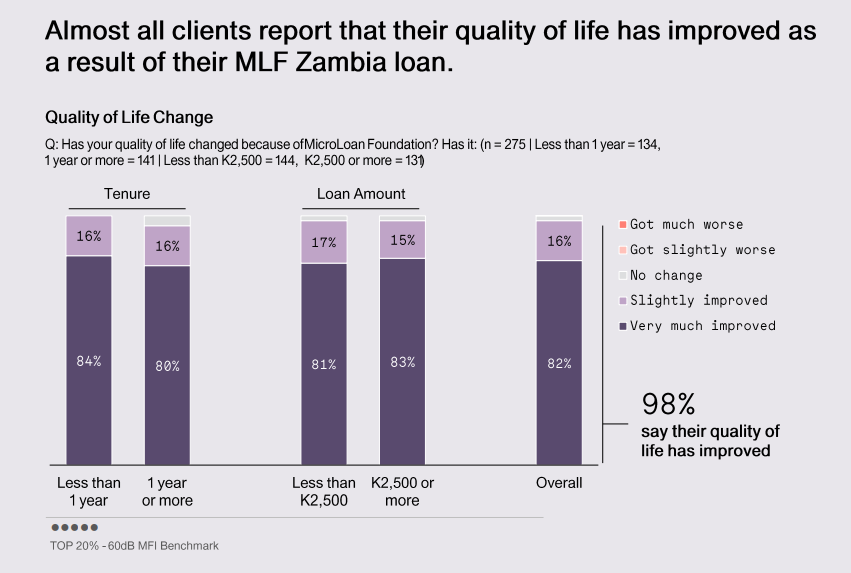

What’s more, 98% of our clients reported an improvement in their quality of life. This is an incredibly positive outcome and demonstrates the effectiveness of our programs in combatting financial hardship. It is heartening to see that our efforts are having such a profound impact on the lives of the people we serve, and we are proud to be contributing to their overall happiness and satisfaction.

A staggering 97% of clients reported that they now have an improved ability to face unexpected expenses, which is a clear indication that our services are helping to alleviate financial stress. In addition, 95% of clients said that they spend less time worrying about their finances, which is a significant achievement in itself. These figures confirm our commitment to our mission of reducing poverty and improving financial well-being.

We are beyond proud of the results of this year’s MFI Index, and we couldn’t have done it without the support of our investors, Grameen Credit Agricole and Global Partnerships.

These numbers are a true testament to the effectiveness of our approach to combating poverty, and we are more motivated than ever to continue our mission of empowering entrepreneurs and transforming communities. Check out the full report here.